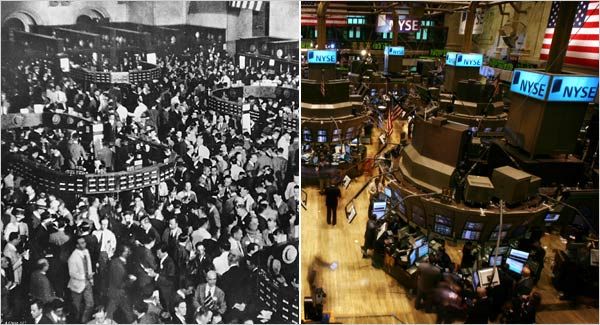

Using technology for making decisions in the stock market is not something which is new.

From the time of bucket shops to today’s highly complex trading platforms, people have tried taking advantage of the technology available to get ahead in the game. Let it be reading the screen at the floor of the exchange or drawing the charts from the price history with hand or using today’s complex tools to use statistical formulas for stock market analysis, traders and investors alike have been very fond of using any and every piece of technology available to analyze the stock market.

This is the era of technology and its use in the stock market cannot be undermined. Big Data technology has improved the common traders or a small investor’s ability to analyze and use it to its fullest. Today Big Data Tech is used by almost everybody in the stock market in some way or the other.

Let it be Banks to Institutional investors or Hedge Funds to a simple day trader, big data technology is helping each and everyone make a more sensible decision. Banks are using this technology to analyse the patterns in various sectors and impact of one sector on another. Private investors are using this tech to manage their portfolios and day traders are using it to make some better decisions to get their prices better.

There are so many portals doing their own research on the stock market like Barchart.com, Breifing.com and Finviz.com and countless others which are providing daily reports and analysis on various stocks and sectors along with a good solid proof of concept. This has become possible because of the use of Big Data Technology and its empowering many others to come forward and do their own research and come up with some new ideas for the future of trading and investing.

Algorithmic trading has already been here for some time now and its now becoming a norm in the stock market. These algorithms have many times helped and sometimes duped (Remember that crash on 06 May 2010 ) their users and other market participants as well. Big Data Technology has empowered computers to analyse the stock prices, be it signal generators or the most complex pattern detectors this technology is helping its user in many ways thereby providing them an edge over the others.

Big Data technology is now empowering the Algorithmic trading in many ways. People are now building newer, better and more complex algorithms to buy and sell the stocks with more precision and granularity. There are deep learning models available these days which will take into account all the features that you care to provide the model and will use them and analyze their impact on the stock price thereby giving us more precise output in terms of prices and patterns. These models are very useful in telling us whether any feature is actually creating an impact on the stock prices or its just one of the several others which just creates some temporary impact and then they become a general norm.

Given all this there arises one implicit Question. Is the stock market trading going to turn into a fully automated game??? Is there any scope for humans and small traders with little or less access to technology to still make some decent money into the market or they are just suppose to sit and watch or choose some other career option altogether. Frankly speaking for these guys making consistent money into the market has actually become a lot more tough than it was in 2010-2011 or before. This technology has taken the essence out of the joy of intra-day trading, but Change is the Law of Nature and stock market is no exception.

So whether will this technology take over this game completely or not, perhaps we will never know, because if there is one thing most certain about the stock market then its that “Stock Market Is Always Right”. So people will eventually get used to these algorithms and patterns those wanting to stay ahead will have to think and innovate new ideas. Thus the only thing I can say with most certainty is that the stock market and all forms of trading let it be day trading or investing, all of them are here to stay all we need is just the right perspective and a lot of discipline and focus. Those who have been on this journey, they know that there is no other thrill like it and this feeling will help them prevail in spite of all these challenges.

With this I would like say good luck to all those “Market Addicts”. Please feel free to like and share this blog post if you find it interesting and please comment if there is any mistake.